Product-market fit (PMF) is one of the most cited yet least understood concepts in early-stage B2B growth. Every founder wants it. Investors expect it. But few can clearly define or measure it - especially beacuse there are multiple definitions out there.

So I sat down with Björn W. Schäfer to dig into what PMF actually looks like, what signals matter, why so many teams fail to reach it, and how to track progress with structure instead of gut feel.

About Björn:

Björn supports B2B SaaS & AI founders with scaling beyond founder sales from 1 to 5M ARR with a proven system and unfair insights.

He is the author of the bestselling GTM book “Funky Flywheels”, a field guide to modern GTM thinking.

In the past 10+ years, he helped 150+ B2B SaaS startups across Europe scale from early traction to real revenue engines – as a founder, sales leader, advisor, and operator.

He also runs the “Funky Flywheels Show” where he interviews founders and explores the secrets behind the scenes.

Last but not least he is an active angel investor.

But enough said about my guest for this episode.

Let’s jump right into the question:

”How can founders tell if they’ve achieved product-market fit?”

How to Recognize Product-Market Fit

Björn doesn't define PMF in abstract terms.

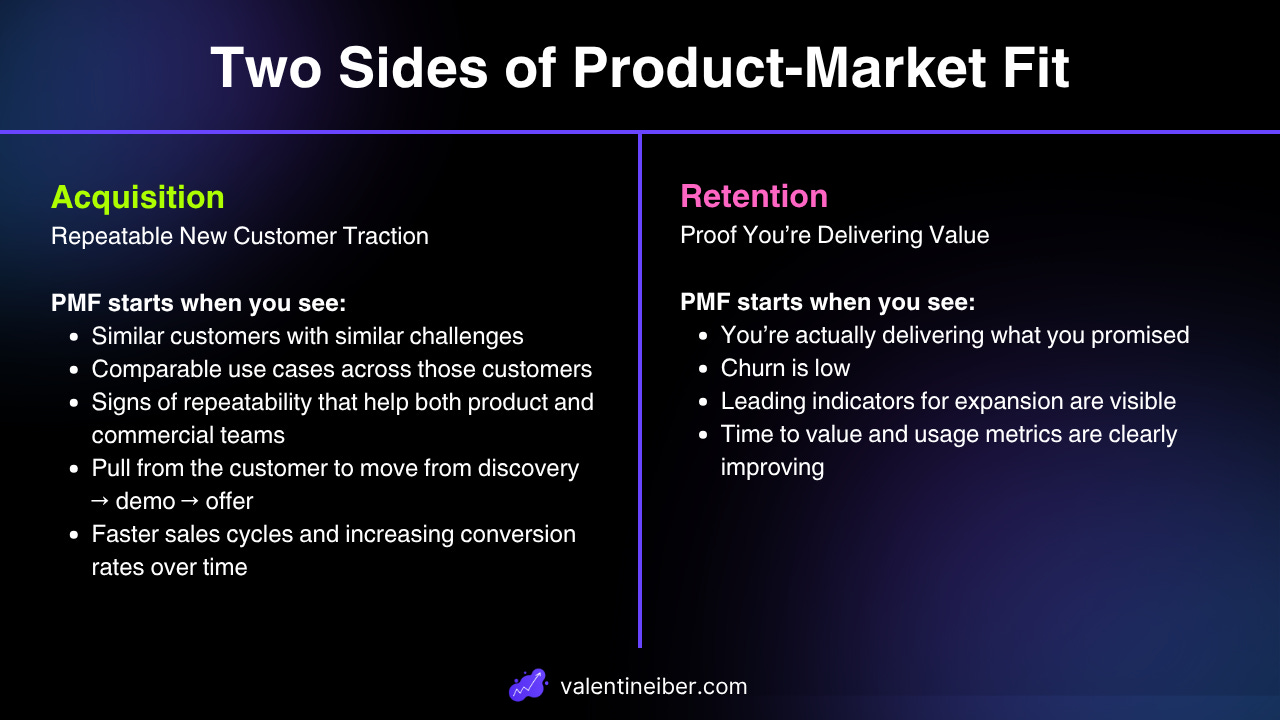

For him, it means two things:

1. Repeatability on the new customer side:

You're winning similar customers with comparable use cases and challenges. That helps both product and commercial teams scale.

2. Proof of value post-sale:

Customers are using what they bought. Churn is low, and ideally, you're seeing leading indicators of expansion.

He’s blunt:

"If you're not delivering what you promised, I don't care if the contract is 12 or 36 months, you don't have product-market fit."

These two sides matter equally. Without a repeatable acquisition engine, you're relying on luck. Without delivery and retention, you're building a leaky bucket.

This is why founders should treat PMF not as a finish line, but as an ongoing validation loop across the buyer and customer journey.

Why Segment-Level PMF Matters More Than Total Revenue

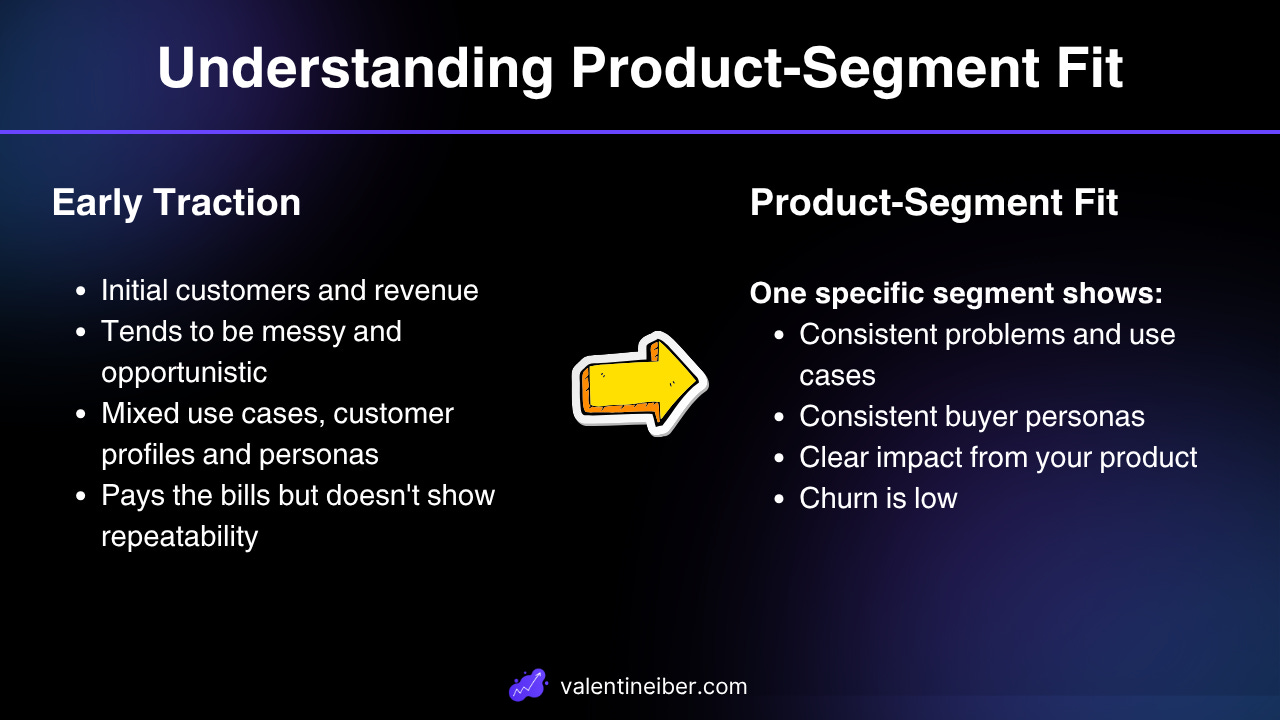

A common trap: celebrating milestones like "1M ARR" without analyzing where it comes from.

You might have sold into 10 different segments to get there. If each segment has different use cases, personas, and onboarding outcomes, there’s no foundation for repeatability.

Björn emphasizes Product-Segment Fit as a precursor to full Go-To-Market Fit.

It’s when one specific segment shows:

Consistent problems

Consistent buyer personas

Clear impact from your product

That segment is your wedge. That’s where you double down.

The Three Most Common Reasons Founders Fail to Achieve PMF

Björn sees these patterns again and again:

1. Lack of strategic focus

Founders try to serve everyone. In reality, they’re doing too many things in parallel, with no depth in any.

2. Misreading early traction

Early adopters may buy on goodwill, not repeatable value. Their success doesn’t scale across a broader market.

3. Chasing revenue instead of outcomes

Investors reward revenue growth. But without healthy usage and retention, that growth is fragile.

He calls this

"doing everything and nothing"

Some companies hit 2M or 3M ARR, but if there’s no segment-level focus or delivery, the whole thing is unstable.

How to Build a Structured Way to Track PMF

Structure matters. Repeatable processes that help you measure what's working.

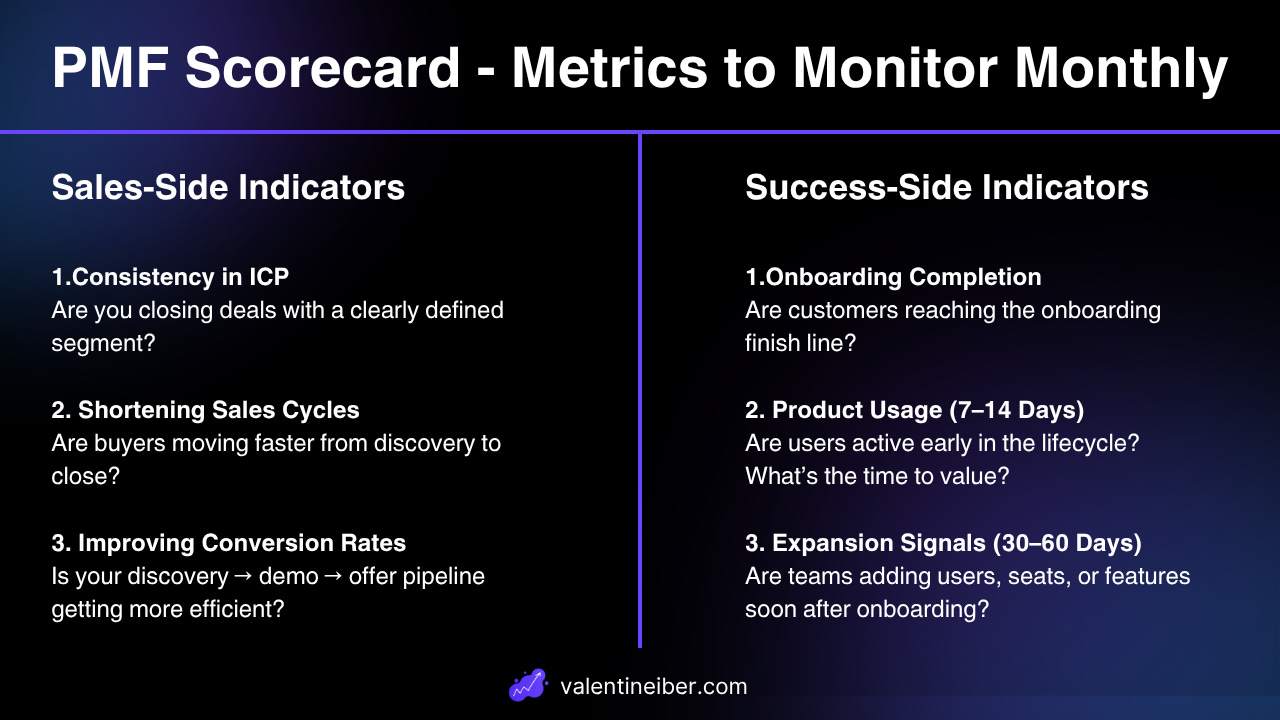

Björn breaks this into two sides:

1. Sales Side – Are you winning the right deals?

Track how prospects move from discovery to demo to proposal.

Build structured discovery frameworks like SPICED or MEDDIC.

Watch for customer pull. Do they proactively want the next meeting?

2. Post-Sales Side – Are you delivering value?

Define what onboarding success looks like

Monitor product usage

Track time to first value and time to impact

Use these as parallel lenses. Winning deals is half the game. Proving value post-sale is the other.

When to Start Building Structure

From my work with early-stage founders I know how much they have on their plat.

So I asked Björn: When to Start Building Structure? Isn’t it overkill at 10k MRR?

He said: Not if you want to avoid chaos.

Björn recommends adding light structure from the first real deals:

Framework for discovery calls

Standardized demo outline

Clear offer presentation

This helps you:

Spot patterns early

Disqualify bad fits faster

Save time and energy

You don’t need a RevOps team. You need consistency. You need signal.

Key Metrics That Actually Indicate PMF

Beyond ARR, track these leading indicators:

Consistency in ICP across deals

Shorter sales cycles over time

Increased demo-to-close conversion

High onboarding completion rates

Engagement in product within 7 to 14 days

Expansion signals within 30 to 60 days

Metrics like these show whether your business is becoming predictable – and scalable.

A Note on Founder-Led Sales

In early stages, founders are doing the selling. That’s how it should be.

But without structure, it becomes chaotic:

Every sales call is custom

You forget to ask key discovery questions

You spend hours on deals that don’t convert

Björn’s advice: use structure to protect your time.

Have a clear qualification checklist

Know when to walk away

Treat early sales as a learning lab

Final Advice to Founders

"Please don’t reinvent the wheel," Björn says. "There are proven methods to run a discovery call, to deliver a demo, to structure your offer. Use them. Then tweak."

PMF is not a single moment. It’s a path.

If you build a system that lets you see and respond to those patterns, you’ll find PMF sooner, and with less chaos.

Big shoutout to Björn for taking the time to share his thoughts about PMF.

Feel free to leave your feedback in the comments, if this article was of any help. 🫶

Cheers

Valentin

Want to learn more about B2B?

Subscribe to the newsletter and follow me on LinkedIn.