The Ultimate Guide to Customer Interviews

Learn how to run interviews that shape your ICP, messaging, and GTM - with a free scorecard template and AI-powered analysis prompt.

Trying to grow without customer interviews is like launching without GPS. You're guessing.

Customer interviews are the most underrated growth lever for founders. Whether you’re trying to shape your product, refine messaging, or just figure out where your audience hangs out, talking to real people is your unfair advantage.

In this guide you will learn:

Why interviews are your secrete sauce to success

How to run interviews that clarify your ICP, messaging, and GTM strategy

What questions to ask to uncover pain, triggers, and buying behavior

How to find and approach the right people, even if you don’t have customers yet

How to analyze interviews and spot patterns that inform your next move

Why Customer Interviews Matter

Customer interviews don’t just help you build better products and messaging, they also give you the raw material for faster, cheaper growth. Every interview is a source of real language, stories, and objections you can turn into content:

LinkedIn posts, landing pages, case studies, and cold email copy.

“Your job isn’t to guess what your audience wants and thinks. Your job is to listen until they tell you.”

Forget assumptions and abstract personas. The best founders talk to their market regularly, especially if you’re early-stage and haven’t found product-market fit yet.

Use this guide as:

A starting point for customer discovery

A bridge between your ICP work and your GTM motion

A scalable research process to repeat at every growth stage

This guide gives you a simple structure to:

Define and refine your ICP & Persona

Learn where your ideal buyers spend attention

Capture real language and decision triggers for messaging

Fuel your channel strategy from actual buyer behavior

Btw, in one of my recent expert interviews I talked with Gabriel Böker about How to Use and Conduct Interviews to Improve Marketing & Sales - highly recommend you check it out as well.

How Many Interviews Should You Run, When and How Long?

Here’s a simple breakdown depending on your stage and goal:

🟢 Early-stage (no users yet)

Number: 8–12 interviews

Length: 30–45 minutes each

Who: Potential buyers who match your ideal persona

Also check out this article about how to find Problem-Solution Fit (Fast)

🔵 Post-launch (some users)

Number: 6–10 interviews

Length: 30–45 minutes

Who: A mix of actual users and non-users in your ICP

🟣 Refining messaging or GTM strategy

Number: 4–6 interviews

Length: ~30 minutes

Who: Ideal customers or high-fit leads

🔁 Ongoing insight loop (maintenance)

Number: 2 interviews per month

Length: 20–30 minutes

Who: Recent customers, churned users, or ICP-aligned leads

Keep in mind:

Patterns emerge fast, often by interview 4 or 5

It’s not about having huge sample sizes, it’s about signal consistency

If you’re hearing the same stories repeatedly, that’s a good sign

If every interview sounds wildly different, you probably need to tighten your ICP

It’s better to go deep with 5 interviews than rush 20 surface-level calls

Part 0: Finding the Right People & Booking Interviews

Before you ask great questions, you need someone to talk to.

Most founders don’t run enough interviews, not because they’re lazy, but because they’re not sure how to approach people without it feeling awkward or salesy.

Here’s how to do it simply and effectively:

Who Should You Interview?

Start with people who:

Match your Ideal Customer Profile (ICP)

Recently solved the problem you’re focused on

Said “no” to your product or a competitor

Follow relevant influencers or join industry Slack groups

You don’t need customers to start, you need signal from people with the pain you’re solving.

How to Ask for an Interview

Keep it simple, direct, and non-transactional. Here’s a high-converting message you can use on LinkedIn, email, or Slack.

Sample cold DM or email:

Hey [First name], I’m doing a few short interviews with [job title]s to better understand how they deal with [problem].

You’re not being sold anything, I’m just trying to learn from smart people in the space.

Would you be open to a 20–30 minute call? Happy to share notes afterwards if helpful.

Thanks either way!Pro Tips for Getting More Yeses

Mention how you found them (“saw your comment in X Slack group” or “followed your post on Y”)

If you have mutual connections, ask for an intro

Be clear that it’s not a sales call

Where to Find Interviewees (Especially if You’re Early-Stage)

Slack communities (e.g. PLG, RevGenius)

LinkedIn keyword + job title search

Existing email list (even if small)

Competitor case studies & clients → find similar people

Reddit, Discord, niche forums

Substack comments or industry newsletters

Part 1: Interviewing to Define Your ICP & Persona

Defining your Ideal Customer Profile (+ Personas) is one of the most crucial parts in every Go-To-Market motion.

It’s foundational to everything that comes after, from GTM strategy to your sales-deck and your homepage copy.

In this article you learn more about how to this + how you can use it to increase your website conversion rate.

When it comes to defining your ICP, interviews help you understand:

Who you’re trying to help & selling to

What your audience cares about

Why they might buy a solution like yours

A) Ask About Their Job & Context

What does your day-to-day look like?

What are you responsible for?

What KPIs or outcomes are you measured on?

What does success look like in your role?

Goal: Get clear on function, level, and what “value” means to them.

B) Ask About Pain & Priorities

What are the biggest challenges you're facing in your job right now?

When was the last time you encountered [problem/challenge]?

What’s most frustrating about that problem?

What happened? How did you try to solve it?

What workarounds did you create?

What didn’t work and why?

How often does this problem arise? What does it cost you, in time, money, effort, or stress?

What other solutions have you tried? Why did they fail?

Goal: Validate if the problem is real, painful, and urgent.

C) Ask About Their Buying Process

When was the last time you bought something for this team or this problem?

What did that process look like? Who else was involved?

What made you trust one vendor over another?

Who decides on the budgets?

Goal: Understand how decisions are made (especially in B2B or team settings).

D) Ask About Language & Positioning

How would you describe this kind of tool or solution to a colleague?

What other tools or solutions do you know?

How do they differ?

Goal: Collect real phrases you can reuse in messaging and content.

Part 2: Interviewing to Find Out Where Your Audience Hangs Out

(Ideal once you know your ICP)

Now it’s time to ask:

Where can we reach them?

Who do they trust?

What do they already pay attention to?

These insights fuel your GTM channel strategy and prevent wasted marketing spend.

A) Ask About Attention & Discovery

Where do you go when you want to stay up to date in your field?

Are there any newsletters, podcasts, or blogs you actually read or listen to regularly?

Who do you follow on LinkedIn or Twitter?

Are you active in any Slack groups, Discords, or communities?

What tools do you use daily and how did you find them?

Goal: Build a shortlist of channels and watering holes.

B) Ask About Decision Triggers

What made you finally take action on [pain/problem]?

Was there a moment that pushed you to start looking for solutions?

What kind of content helped you make your decision?

Goal: Spot buying signals and moments of high intent.

C) Ask About Messaging Hooks

What kind of messaging resonates with you?

Have you seen a campaign or ad recently that really stood out? Why?

What’s the most annoying thing vendors say?

Goal: Know what to avoid and what connects.

Part 3: Evaluating & Interpreting Interviews

Now it’s time to turn the raw conversation data into GTM clarity.

Once you’ve done a few interviews, your head might be full of quotes, anecdotes, and scribbled notes. The question becomes:

“So… what do I do with all this?”

This is where evaluation and interpretation comes into play.

Recognizing patterns and making strategic decisions.

Step 1: Organize What You Heard

Use a simple structure to summarize every interview:

Pain — What are they trying to solve?

Triggers — What made them start looking?

Channels — Where do they spend time?

Tools — What do they already use?

Phrases — What exact words did they use?

This structure makes it easier to spot recurring themes across interviews.

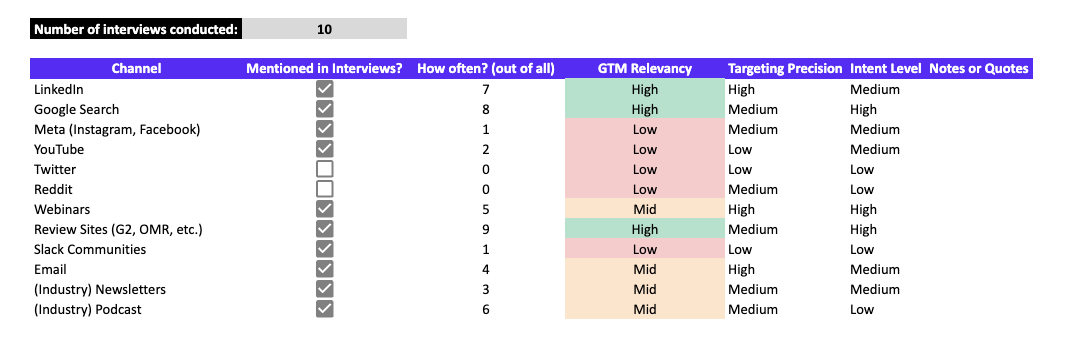

Step 2: Score Channel Fit Based on Mentions

As patterns emerge, plug them into your Channel Fit Scorecard. For each channel (e.g. LinkedIn, SEO, Slack), ask:

Did this channel get mentioned?

How frequently (in how many interviews)?

What was the context? (Trusted source? Decision point?)

Use your total number of interviews to calculate what % mentioned each channel. Then categorize them:

Mentioned in ≥ 70% → ✅ High Relevance

Mentioned in 30–69% → ⚠️ Medium Relevance

Mentioned in < 30% → ❌ Low Relevance

This helps you prioritize your GTM experiments: start where signal is strongest.

→ The Channel Fit Scorecard Template

After 5–10 interviews, you’ll start to see patterns. Use this Channel Fit Scorecard Template to turn answers into insights for your GTM strategy.

It automatically shows you the relevancy of each channel for your GTM motion, based on the total number of interviews conducted and how often the channel was mentioned.

→ Use ChatGPT to Summarize and Score Your Interviews

After each interview, paste the transcript into ChatGPT and use this prompt to extract insights based on Pain, Triggers, Channels, Tools, and Language - plus automatically extract channel mentions and real buyer language/quotes.

How to Use It:

Upload your transcript (as TXT) in ChatGPT

Copy/paste the prompt

Copy/paste the results into your scorecard template

You're acting as a Go-to-Market strategist helping a B2B founder analyze a customer interview.

Below is the transcript of an interview with someone in their ICP. Please extract the following insights:

1. PAIN: What problems or frustrations did they mention?

2. TRIGGERS: What events, milestones, or changes pushed them to start looking for a solution?

3. CHANNELS MENTIONED:

- List all the places (platforms, communities, media, tools, search engines, etc.) the interviewee said they use to:

a) stay informed

b) research solutions

c) discover new tools

- For each channel mentioned, include the **exact quote or best paraphrased sentence** that supports it.

4. TOOLS: What software or services did they say they use regularly?

5. LANGUAGE: What specific words, phrases, or mental models did they use to describe the problem or solution?

Please format your response like this:

---

### Interview Summary

**Pain:**

...

**Triggers:**

...

**Tools They Use:**

...

**Notable Phrases / Messaging Hooks:**

- "..."

- "..."

### Channels Mentioned (with Quotes)

| Channel / Source | Quote or Supporting Sentence |

|----------------------|------------------------------|

| LinkedIn | “I usually check LinkedIn to see what others in my role are doing.” |

| Google Search | “I just Googled something like 'best CRM for agencies’.” |

| Slack Community | “I posted the question in RevOps Co-op.” |

| G2 | “I read a couple of reviews on G2.” |

| Podcasts | “I listen to [X podcast] to keep up with trends.” |Step 3: Look for Alignment + Gaps

Ask:

Are the most trusted channels also where we have presence today?

Are we spending time/money in places nobody mentioned?

Where are we under-invested, but buyers hang out?

Use insights not just to validate what you're doing, but to reallocate effort toward what works.

Common Interview Mistakes

Talking too much

Ask short, open-ended questions. Then shut up. If there’s silence, let it sit.

That’s often when the best stuff comes out.Asking leading questions

Leading questions are questions that subtly suggest or assume a certain answer. They bias the respondent, often without you realizing it.Instead of uncovering truth, they push people toward confirming your idea.

Example:

“How frustrating was it when you couldn’t get that feature to work?”

➡️ Assumes the experience was frustrating. The person might’ve been fine with it.Not digging deep enough (“why” only once)

When someone gives you an answer, ask “Why?” - then do it again.

Often by the 3rd “why,” you’ll uncover something strategic.

→ Check out the 5 Whys FrameworkSkipping non- & ex-customers

Talking only to active users or fans creates a warped view of your market. You miss friction, confusion, and the perspectives of people who didn’t convert or left.Trying to pitch during the interview

The moment you start selling, the interview turns into a demo call.

f they ask about your product, politely say:“Happy to share at the end if there’s time, but for now I just want to understand how you see things.”

Final Tips for Founders

Have fun! Interviews are exciting and you get to learn a lot, try to enjoy it.

Always record (with permission), then use AI to summarize, structure and extract quotes.

Document learnings in themes: Pain | Triggers | Channels | Tools | Phrases

Interviews aren’t one-off. Make them a monthly habit.

“The earlier you talk to your customers, the fewer pivots you’ll need later.”

Leave your feedback in the comments, if this article was of any help. 🫶

Cheers

Valentin

Want to learn more about B2B Growth?

Subscribe to the newsletter and follow me on LinkedIn.